does binance us report to irs

You should report crypto taxes whether IRS knows about it or not. Please visit this page to learn more about it.

Does Binance Us Report To The Irs Quora

Additionally new regulations will require.

. We cannot know for sure whether or not the exchanges submit trading information to the IRS. This means that no by default BinanceUS does not report to the IRS. Does Binance US report to the IRS.

Depending on the countrys regulatory framework when you trade commodities and the event produces capital gains or losses you would have to pay taxes duly. Binance does not provide tax advice. Coinbase will report your transactions to the IRS before the start of tax season.

Does Coinbase report to IRS 2020. ThaJokes articles are based on information we have collected from all over the internet. Binance gives you a detailed report of your crypto transactions thatll help you file your tax returns to the IRS.

However it is no longer serving US-based traders so Binance does not report to the IRS. Follow the steps below to get started or read our in-depth guide here. This goes for ALL gains and lossesregardless if they are material or not.

No Binance does not report to the IRS since it is non-operational in the US. After recent speculations on the legitimacy of Binance is required to do KYC and AML verification which means that it has to report all its user information to the government. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada.

The parent company stopped allowing US investors a couple of years ago which was why Binance US got started in the first place. The IRS is putting pressure on all cryptocurrency exchanges to share customer data to ensure tax compliance. A new question- At any time during 2021 did you receive sell exchange or otherwise dispose of any financial interest in any virtual currency is now being added in the tax form of the IRS.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Binance US the American arm of the popular cryptocurrency exchange Binance has not been reporting its customers transactions to the Internal Revenue Service IRS according to a report from The Block. The exchanges are having a m.

Binance has a long and complicated history with the IRS. Because it no longer serves traders in the United States Binance does not have to report to the IRS. Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties.

Binance a Malta-based company is one of the most popular crypto exchanges in the world. Binance a Malta-based company is one of the most popular crypto exchanges in the world. Many crypto exchanges send tax forms to the IRS each with their own list of supported tokens and info that doesnt necessarily match up.

Does Binance US report to the IRS. Please note that each user can only create one Tax Report API and the tax tool functionality only supports read access. Many significant exchanges like Coinbase Binance and Kraken send different tax forms to the IRS for instance Coinbase reports 1099-MISCs and.

Does Binance com report to the IRS. How do exchanges report tax information. Does Coinbase report to the IRS.

The agency has successfully compelled US-based exchanges such as Coinbase to share mass user data through the use of John Doe summonses. Binance gives you the option to export up to three months of trade history at once. When you receive a 1099-K form from a crypto exchange the IRS gets a copy too.

Log in to your Binance account and click Account - API Management. Binance US was launched in. I think they started to.

Binance US reports to the IRS. Even if you dont qualify for this form you are still required to report all cryptocurrency transactions to the IRS every tax season. If you receive a Form 1099-B and do not report it the same principles apply.

Yes Binance does provide tax info but you need to understand what this entails. 1099s of all types serve the same purpose within the United States all 1099s report non-employment related income. Click Create Tax Report API.

Coinbase reporting 1099-K B subpoenas and 1040 schedule 1 are ways IRS knows you ow crypto taxes. As of now however with the exception of Coinbase which was ordered to turn over information concerning some of their higher-volume clients it is doubtful. Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS.

This non-compliance could have serious consequences for Binance US customers as the IRS could come after them for unpaid taxes. Cointelli Makes It Easy to Report Coinbase Binance and Kraken Transactions to the IRS 4 days ago. Binance previously issued a 1099-K form to users with more than 200 transactions totaling more than 20000 in value throughout a single financial year.

We rely on reliable sources when gathering data. With Binance you are now able to have all your transactions tracked and accounted for automatically with our Tax Tool Functionality. Cryptocurrency exchanges like Coinbase Gemini and others that operate within the US.

BinanceUS makes it easy to review your transaction history. Answer 1 of 5. However this does not at all mean that the IRS cannot gain access to your BinanceUS transaction records.

After further evaluation and general indications from the IRS on the intended direction for future reporting BinanceUS has decided not to issue Forms 1099-K for customers on the exchange for the tax year 2021 and beyond. Market use a specific type of 1099 Form to report tax information to the IRS. If you earned at least 600 through staking or Learn and Earn rewards Binance US will issue a 1099-MISC and report to the IRS.

Binance based in Malta is one of the most well-known cryptocurrency exchanges in the world. Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040.

Instead it maintains a separate website for American traders called BinanceUS. These kinds of incomes are classified as ordinary income. Based exchanges such as Coinbase and Gemini will fill out IRS forms for you Binance only gives a list of all your trade history.

However it is no longer serving US-based traders so Binance does not report to the IRS.

Binance Faces Probe By Us Money Laundering And Tax Sleuths 1

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

3 Steps To Calculate Binance Taxes 2022 Updated

Does Binance Us Report To The Irs

Cryptocurrency Tax Reporting Tool Binance Us

Binance Us Cryptotrader Tax Demo Automating Your Crypto Tax Reporting Youtube

Does Binance Us Report To The Irs

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

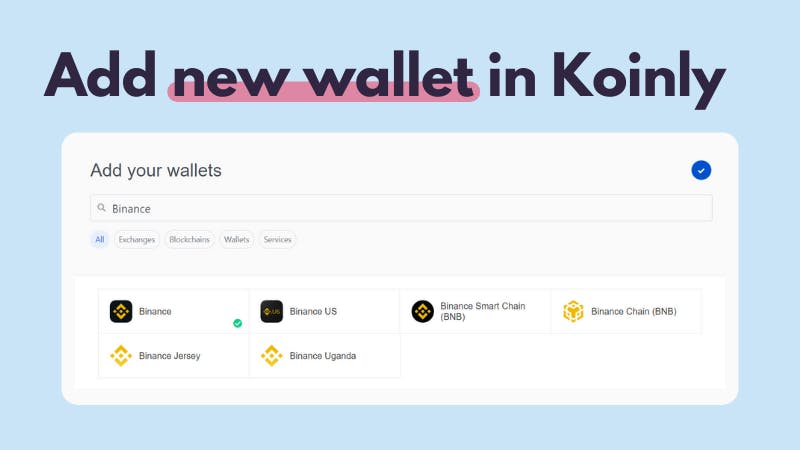

The Complete Binance Tax Reporting Guide Koinly

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Does Binance Report To The Irs Tokentax

Does Binance Us Report To The Irs Quora

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Does Binance Us Report To The Irs

Does Binance Us Report To The Irs

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support